State run oil company GNPC in talks with Shell over East Keta basin

- Details

- Created on Thursday, 10 April 2014 14:59

Ghana National Petroleum Corporation (GNPC) is in talks with Royal Dutch Shell (RDSa.L) (RDSb.L) over an exploration and production deal in the offshore East Keta basin, GNPC's chief executive said at the Reuters Africa summit.

Alex Mould gave no details of the deal's scope in the basin, which lies in the Gulf of Guinea between the port city of Tema and the Togolese border to the east.

But he said a Shell deal could open the door to other major producers.

"We are in discussions right now with Shell in the East Keta basin. We are also in discussions with Chevron (CVX.N). They are looking at where they want to come in the data room and we should hear from them in a couple of months," Mould told Reuters.

"We still have to make contacts with Exxon-Mobil (XOM.N) and we believe that with the advent of Shell, who are in discussions with us right now for a petroleum agreement, will encourage the rest of them to come in," he said.

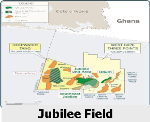

Ghana began pumping oil in December 2010 at its offshore Jubilee field to the west, where Tullow Oil (TLW.L) has the largest stake and production is expected to hit 110,000 barrels per day in 2014.

Jubilee, the only oil field in Ghana currently producing, lies southwest of the port city of Takoradi and close to the border with Ivory Coast.

GNPC is also in talks with UB Petroleum, A-Z Petroleum and Heritage Oil (HOC.TO) over the award of licenses on new oil blocks, Mould said, though he declined to give details of the block locations or the value of any deals.

"There is absolutely a huge demand in the Ghanaian upstream sector. The last four blocks we gave we had over 25 applications and on the average we have about six applications for every block," Mould said.

SLIM HOLES

GNPC is spending about $20 million to drill six narrow holes to determine a hydrocarbon presence in the onshore Voltaian basin, which would bring years of work to fruition. The next step would be a full-scale seismic survey before the blocks can be divided up.

"We are in the approval stage of the public procurement process which is very elaborate in Ghana and it's taken us currently four months. We believe the project will cost us about $20 million," Mould said.

When Ghana struck oil in 2007 it generated a burst of optimism for the economy and the year after production began GDP growth spiked to 11.8 percent.

Of late, however, a delay in constructing a pipeline to bring gas onshore from the Jubilee field has held production back.

Mould said GNPC had plans to increase its stake in the Tweneboa-Enyenra-Ntomme (TEN) fields, which lie about 20 km (12 miles) west of the Jubilee field following a decision by Tullow Oil to sell part of its almost 50 percent stake.

"GNPC had already informed Tullow that they were interested in the farm-down, so if Tullow gets a partner GNPC will like to be within that group of the farm-down," he said. The corporation currently holds a stake of around 15 percent, officials said.

He added that Tullow had put on hold for several months plans to find a partner.

source: reuters