US$7 billion ENI gas deal badly negotiated

- Details

- Created on Monday, 02 March 2015 14:05

The country stands to lose significantly from the US$7billion natural gas deal reached with ENI and Vitol if IPPs in the power sector opt for cheaper gas from abroad, said a source that is apprehensive about the 20-year deal in which government agreed to buy gas at US$9.00 per million standard cubic feet.

The source wondered why the deal had to be taken away from the Petroleum Commission, which was negotiating for between US$4.00 and US$6.00 and brokered at a “higher level.”

“With shale gas and cheap gas from Qatar and other places coming in, we could be in for trouble,” the outside-government source said. “Now that we are looking to IPPs to develop our power sector it is no longer going to be government controlled, and they are business people.

"They are not necessarily interested in your gas; they are interested in bringing in cheap fuel. Once they have a guaranteed tariff, they are looking at how to reduce cost to make more profit and not how to buy gas automatically. So if they can get gas cheaper somewhere they will opt for that.”

While General Electric has already given indication it is going to bring in gas from abroad for its 1000megawatt thermal project, the 10-year 450megawatt deal with Karpower of Turkey has a fuel import component, and there are other LNG projects in the works with Quantum Power and other companies.

The source therefore foresees government having to, in the future, force its troubled power generator -- the VRA -- to come up with thermal projects that consume the 170 million cubic feet of gas per day expected from the ENI deal beginning 2018.

“And when that happens, where will the money come from?”

Not only does the source consider the US$9.00 price to be on the hide side, it criticised government for securitising oil revenues to be derived from the TEN project against gas sales from ENI…and also prioritising disbursement to ENI.

“This contract can collapse our oil industry.”

Government, the source added, also guaranteed a flat interest rate of 7% on all the loans to be secured by ENI and co for the project, which has a debt to equity ratio of 2:1.

“So if they go and negotiate 2% interest rate loans, they have a free 5%. If GNPC has been able to negotiate a loan at 5%, why do you give ENI 7% when they are bigger and have more credibility?” the source asked.

“So if ENI has money sitting somewhere they can loan it to the project…ENI is smiling all the way to the bank.”

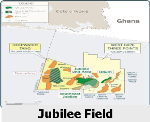

Agreement on the Plan of Development for the Offshore Cape Three Points (OCTP) integrated oil and gas project (Sankofa and Gye Nyame fields) with ENI and Vitol was signed on January 27, 2015, with President Mahama calling it the single largest investment that is being made in an African country "in this particular year”.

Some 80,000 barrels per day of oil are expected from the project from 2017, while 170 million cubic feet of gas per day are expected the following year.

source: ghanaweb citing B&FT as source